The Origins of Currency and the Barter System

How It All Began: Trading Without Money

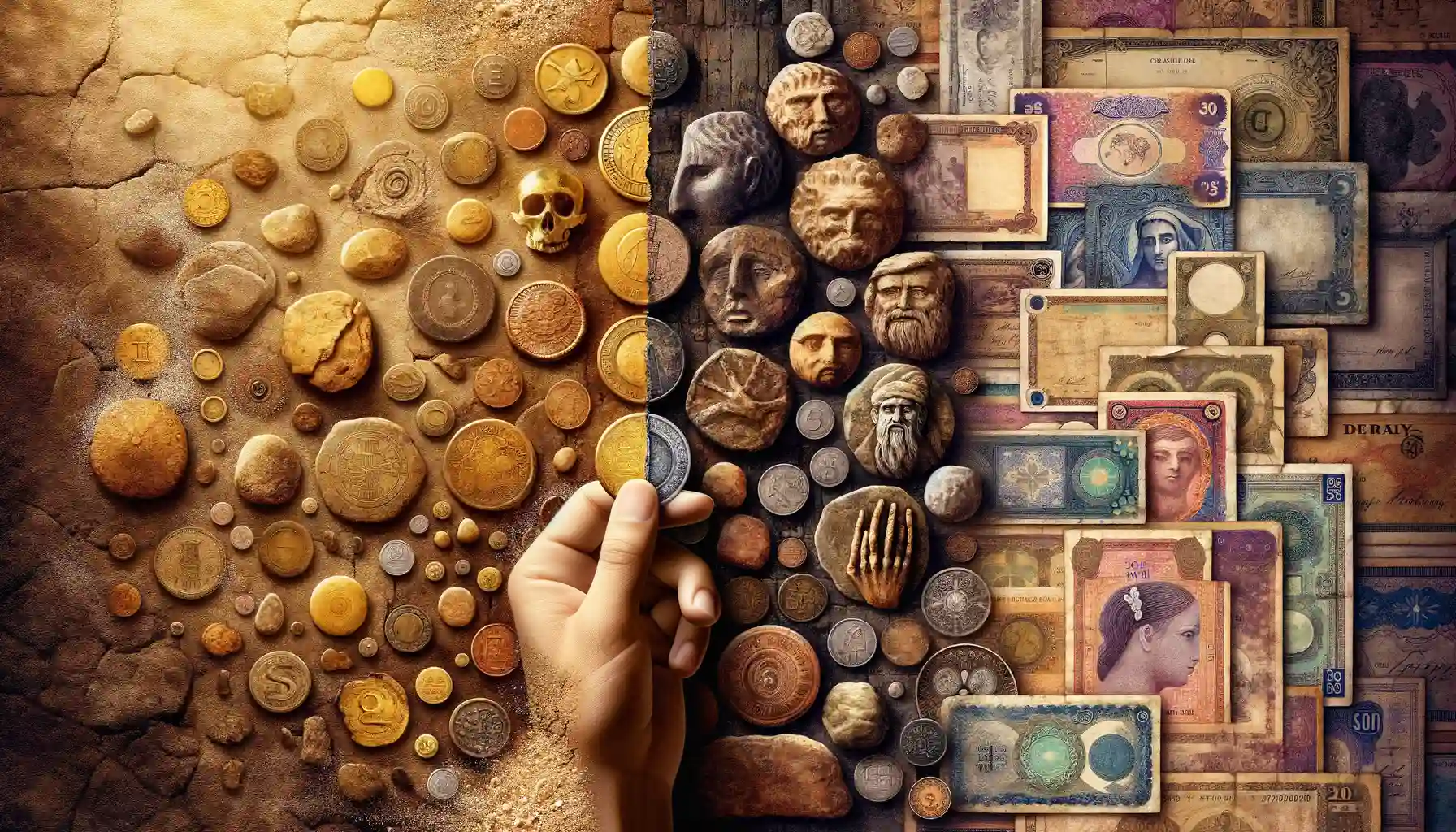

Picture this: centuries ago, before wallets and bank accounts, people lived in a world without money. Need food? Trade something you own. Got extra grain? Swap it for a shiny new pot or maybe a goat. This system—known as bartering—was humanity’s first attempt at exchanging value. It was simple but far from perfect.

The problem? Not everyone wanted what you had. Imagine trying to trade your flock of chickens for a loaf of bread when the baker already had too much poultry. That’s where the concept of “universal value” entered the picture—a solution to the pesky issue of “I don’t need what you’re offering.”

The First Universal Tools of Trade

To solve this dilemma, early civilizations turned to objects everyone considered valuable, like:

- Salt: Yes, that humble seasoning was once so prized it doubled as wages for Roman soldiers (which is where the word “salary” comes from!).

- Shells: In some cultures, colorful shells became a highly sought-after currency.

These precious items didn’t spoil, were easy to carry, and more importantly—everyone agreed on their worth. The seeds of modern currency were planted, and humanity’s financial journey had officially begun.

The Emergence of Coins and Paper Money

From Metal Marvels to Paper Miracles

Imagine a bustling marketplace thousands of years ago. Farmers exchange sacks of grain for bundles of wool, but what happens when one farmer doesn’t need wool? Enter the game-changer: **coins**. Crafted from precious metals like gold and silver, these portable marvels shimmered with inherent value. No longer bound by the complications of bartering, transactions became smoother—faster than you could say “trade done!”

Coins weren’t just practical; they were power symbols. Ancient rulers stamped their faces onto coins to flex their authority. Holding one in your hand wasn’t just holding money—it was holding a piece of the empire.

But metal has its weight, literally. Carrying piles of coins? Not ideal. And this is where we meet an unassuming hero: **paper money**. Originating in China during the Tang Dynasty, these lightweight, portable notes forever redefined commerce. By the time paper bills spread to Europe, they revolutionized global trade.

- A single coin could feed a family—or buy a weapon.

- Paper money, on the other hand, traveled light yet funded wars and empires.

Isn’t it fascinating how something as simple as a slip of paper or a shiny round disc could carry so much power?

Digital Revolution: The Rise of Electronic Payments

The Shift from Wallets to Smartphones

Picture this: a crowded coffee shop, your hands full with your favorite latte, and no digging through a wallet for cash or cards. Instead, a simple tap of your phone completes the transaction. This isn’t a futuristic fantasy—it’s the everyday magic of electronic payments.

In today’s fast-paced world, convenience is king. Electronic payments have turned our smartphones into portable banks. Whether it’s splitting dinner bills on apps like Venmo, tapping into online marketplaces with credit cards, or swiping through platforms like Apple Pay, the way we exchange money has become faster, sleeker, and utterly seamless.

Why We’re Hooked on Digital Payments

Here’s why electronic payments are stealing the show:

- Speed: Transactions happen in seconds—no more waiting for change or fumbling with checks.

- Accessibility: Whether you’re lounging at home or halfway across the globe, digital payments follow you everywhere.

- Security: Features like encryption and multi-factor authentication keep your funds locked tighter than Fort Knox.

But it’s not just about ease; it’s a shift in how we think about money. The sight of physical cash is becoming as rare as spotting a payphone! Virtual wallets now dominate, changing not only our habits but also our mindset around spending and saving.

And admit it—it feels empowering to send cash with a mere swipe.

Cryptocurrency: Bitcoin and the Blockchain Era

The Birth of a Digital Gold Rush

Imagine a world without banks, where financial transactions don’t require middlemen. That’s exactly what Bitcoin ushered in—a revolutionary shift that knocked on the doors of tradition and boldly walked in. Back in 2009, a pseudonymous genius known as Satoshi Nakamoto introduced Bitcoin, a decentralized digital currency powered by blockchain technology. No minting presses, no borders, just lines of code. It was as if currency evolved a brain of its own!

At its core lies the blockchain, an unhackable public ledger where every transaction is etched like carvings on an indestructible wall. What does this mean for you? Security, transparency, and freedom. Goodbye bank fees, hello financial control.

- No more waiting days for international transfers—blockchain cuts that down to minutes.

- Own your money completely. No one can freeze it, seize it, or charge you hidden fees.

- With finite Bitcoin supply (21 million coins), scarcity mimics gold but with a futuristic twist.

Real-World Use: From Pizza to Empires

Believe it or not, the first real-world Bitcoin purchase was for two pizzas in 2010—a whopping 10,000 BTC spent! Fast forward, Bitcoin is now accepted by companies like Tesla and global platforms, reshaping industries. Imagine owning currency that’s not tied to politics or physical borders but innovation itself.

It’s no longer just a means of exchange; it’s a movement. Whether you see it as a wild west or a tech marvel, there’s no denying: Bitcoin has flipped the currency script forever.

The Future of Money: Trends and Predictions

Shaping Tomorrow’s Wallets

The way we interact with money is undergoing a revolution, and it’s nothing short of electrifying. Imagine a world where your morning coffee is paid for by scanning your palm or where paper bills feel as ancient as fossils. That’s the direction we’re heading—and it’s happening faster than you think.

So what’s buzzing in the financial world? Look no further than these game-changers:

- Central Bank Digital Currencies (CBDCs): Countries like China are already racing ahead with digital versions of their national currencies. Forget wallets—your smartphone could soon hold your entire monetary universe.

- Decentralized Finance (DeFi): Picture taking out a loan or earning interest without ever walking into a bank. Powered by blockchain, DeFi platforms are cutting out middlemen and putting control back in your hands.

A Cashless Society: Dream or Reality?

In Sweden, cash is practically a myth. And many regions are following suit, sliding towards a fully digital economy. But will it be all sunshine and no shadows? While the ease of tap-and-go payments is intoxicating, some worry about privacy, cyber risks, and leaving the unconnected behind. It’s a dazzling new frontier, but one that sparks both hope and caution.

The future of money might just make your head spin—but in the best way possible!